Neat Tips About How To Pay For Usc

The principles of financial planning, leveraging various resources, and applying methodologies like Kaizen or innovative problem-solving come into play.

Let's break this down step-by-step:

The principles of financial planning, leveraging various resources, and applying methodologies like Kaizen or innovative problem-solving come into play.

Let's break this down step-by-step:

1. Identify the Total Cost

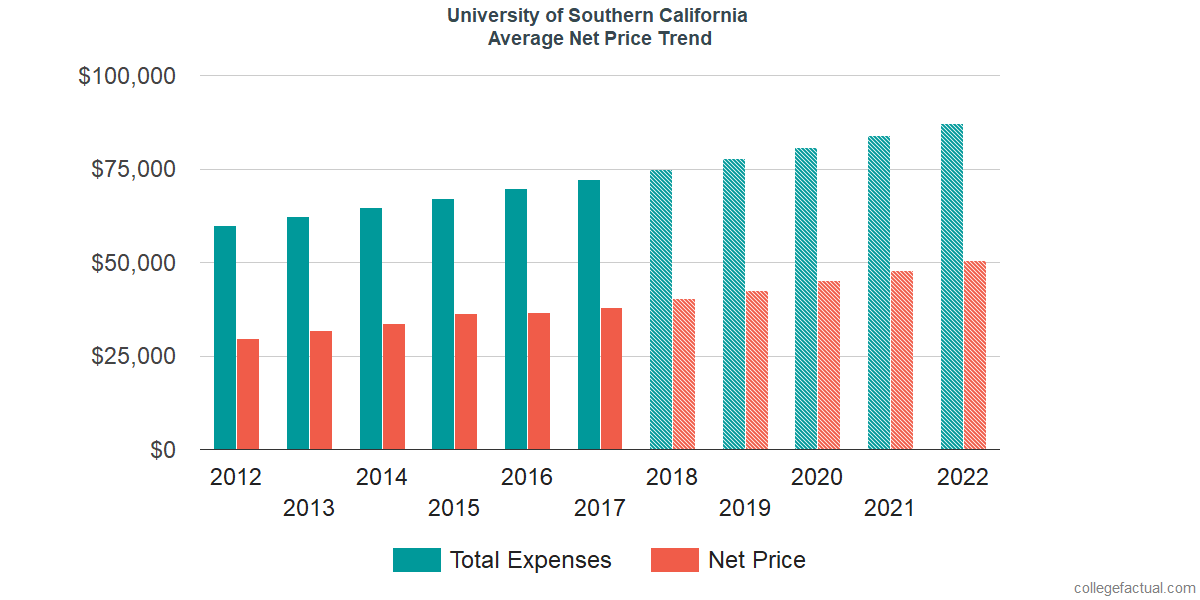

- Tuition & Fees: For USC, tuition can vary depending on your program (undergraduate, graduate, etc.), but as of recent years, undergrad tuition typically ranges between $60,000 and $80,000 per year. Additional costs like fees, books, and housing add to the total cost.

- Living Expenses: Include rent, food, transportation, and personal expenses. The cost of living in LA can vary significantly depending on whether you're living on-campus or off-campus.

- Miscellaneous Costs: Insurance, technology, and any other incidentals.

2. Understand Financial Aid Options

- FAFSA: Start by completing the Free Application for Federal Student Aid (FAFSA). It determines your eligibility for federal grants, work-study programs, and loans.

- USC Financial Aid: USC offers need-based and merit-based financial aid. You will need to apply to receive this aid, which can help cover tuition, fees, and even some living costs.

- Scholarships: USC offers a variety of scholarships for academic excellence, leadership, talent in specific areas (like sports, arts, etc.), and financial need. Research external scholarship opportunities as well.

- State Programs: Some states offer their own grants or funding for students attending universities like USC. For example, Cal Grants are available to California residents.

3. Explore Loan Options

- Federal Loans: After filling out your FAFSA, you’ll be eligible for federal loans like Direct Subsidized and Unsubsidized loans. Interest rates are fixed, and repayment terms are flexible.

- Private Loans: If federal aid doesn’t cover all your costs, you may need to explore private student loans. Compare terms, interest rates, and repayment plans from different lenders.

- Parent PLUS Loans: Parents of dependent students can apply for Parent PLUS loans, which can cover the gap between what the student receives in aid and the total cost of education.

4. Apply Kaizen (Continuous Improvement)

- Track and Adjust: Use the Kaizen philosophy to continuously monitor and adjust your financial planning. Set a monthly budget, track your spending, and adjust if you're overspending or if new opportunities (like scholarships) become available.

- Cut Unnecessary Costs: Kaizen is all about small, incremental improvements. Try finding ways to reduce costs, such as:

- Renting used textbooks or using digital copies.

- Cooking meals at home instead of relying on dining out.

- Living in a more affordable area, if possible.

- Taking advantage of student discounts.

5. Consider On-Campus Employment

- Work-Study Programs: USC offers on-campus employment opportunities for students, and you may be eligible for work-study funding, which allows you to earn money for tuition or living expenses while attending school.

- Non-Work-Study Jobs: If you’re not eligible for work-study, there are still plenty of on-campus jobs. Working a part-time job can help reduce the financial burden.

6. Innovative Solutions (Pokayoke)

- Prevent Mistakes with a Clear Plan: Use a "Pokayoke" mindset (error-proofing) in your financial planning to avoid mistakes that could leave you short on cash. For example, set up automatic payments for your tuition bills, create clear reminders for deadlines related to scholarships, and be proactive about maintaining your eligibility for aid.

- Emergency Fund: It's also smart to build an emergency fund in advance. Even if it’s a small amount, having something set aside for unexpected costs can prevent financial setbacks.

7. External Funding & Crowdfunding

- Crowdfunding: Some students turn to platforms like GoFundMe to help raise money for their education. While this is less traditional, it can be effective in certain situations (e.g., if you have a compelling story or are facing a sudden financial need).

- Employer Tuition Assistance: If you're working while attending USC, check if your employer offers tuition reimbursement or assistance programs. Many companies provide financial aid to employees furthering their education.

8. Maximize Tax Benefits

- Tax Deductions: Look into tax deductions for tuition, student loan interest, and other education-related expenses. The American Opportunity Credit and Lifetime Learning Credit can reduce your tax bill and free up more money for tuition payments.

- 529 College Savings Plans: If you or your family have been saving for your education using a 529 plan, be sure to maximize those funds for tuition and related costs.

9. Long-Term Strategies

- Graduate Assistantships/ Fellowships: If you’re considering a graduate program at USC, look into assistantships or fellowships that offer stipends and tuition remission.

- Repayment Strategies for Loans: After graduation, consider income-driven repayment plans for student loans. These plans are based on your income and family size, potentially lowering monthly payments if you're not making a large salary right after school.

Conclusion: The Mind-Blowing Application

By applying Kaizen (continuous improvement), Pokayoke (error-proofing), and systematic financial planning, you not only ensure that you can pay for USC but also optimize your spending to minimize debt and build a sustainable financial future. This approach isn’t just about gathering money for tuition—it's about creating a holistic financial ecosystem where every step and decision works to your advantage. By seeing how these strategies apply to real life, the seemingly overwhelming challenge of paying for a prestigious institution like USC can be broken down into manageable, deliberate actions that steadily move you towards financial success. It’s like applying lean management to your finances—small, strategic tweaks add up to a substantial impact over time!

Usc To Pay 1.1 Billion Settle Sex Abuse Claims

University Of Southern California Costs& Find Out The Net Price

Usc, City Officials Sign Lease On The Coliseum Daily Trojan

How Much Do You Pay To The Usc? Youtube

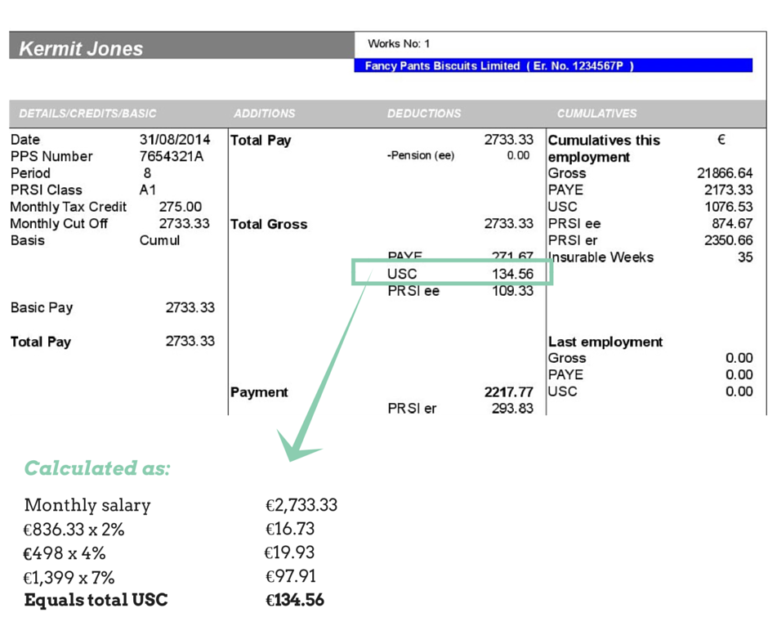

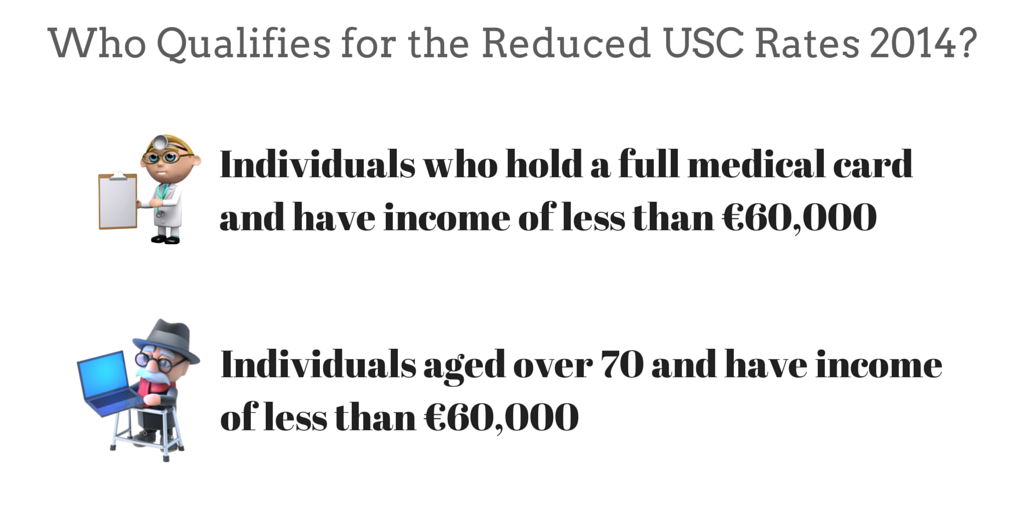

Understanding Your Payslip Part 3 How Much Usc Should I Be Paying

Comments

Post a Comment